- Friend Arvind Sahay at IIM A awarded the Devang Mehta Award for the Best Business Professor in Marketing Management in India. Congrats! #

- That's it? A $4B scam and he just walks away? | The Hindu : Communications Minister Raja resigns http://bit.ly/bA3lOn #

- US senate tooRT @felixsalmon: Mortgage interest deduction is QWERTY keyboard of US taxes. Proved ineffective, but impossible to scrap. #

- 2G scam is worth $40B not $4B. Don't try 1.76 lakh crores in US$ in your head! I support a move from crores to millions http://bit.ly/cCnUSZ #

- Looking forward to the Russell Peters show in San Jose tonight. http://bit.ly/llabd #

- Great charts! | Ezra Klein – Who does the mortgage-interest deduction benefit? http://wapo.st/d11rw2 #

- Too late. I'm sticking with Android now | Google Voice for iPhone on the iTunes App Store http://bit.ly/bjelVK #

- I wonder if Gandhi would have approved of this form of warfare | Worm Was Perfect for Sabotaging Centrifuges | http://nyti.ms/cAlm1W #

Author Archives: Basab Pradhan

IT Services Should be Setting Agenda on Human Cloud

GigaOm’s conference NetWork 2010 next month is about the future of work. Mathew Ingram describes the collaboration in distributed teams as the Human Cloud

The biggest change, for both workers and companies, is a move toward what we call “the human cloud.” In the same way that high-speed Internet access disrupted the corporate IT market, creating a “cloud” of web-enabled infrastructure, the human cloud is shorthand for how the web has disrupted the way we work. Companies rely on dispersed teams to get the best talent available regardless of location (or price) and many are using crowdsourcing and other innovative means to achieve their goals.

If you look at the speaker list for Network 2010 there is not a single speaker from the IT Services industry. Isn’t that disappointing. Offshore is the dominant template for the IT Services industry today. And Offshore is the Human Cloud. Distributed teams around the world plugging in to collaborate to build or troubleshoot systems or carry out business activities. The industry should be defining the future of work. But it is not even at the table.

How are offshore projects run today from a collaboration standpoint? Fifteen years ago the tools for collaboration were email, phone calls and weekly status reports in MS Word. Aside from desktop sharing is it much different than that today? The quality of the phone lines are much better now and occasionally you’ll have a video conference for a sales meeting. But that’s it, isn’t it? Companies try to get clients to log in to their extranet collaboration apps and then when they don’t they quietly bury them. Design is still done by flying people over. And application support is all based on email. Please tell me if it’s any different.

I know a lot of this inertia is because of the resistance to change of corporate clients. But IT Services companies must take the lead. This is your business. Better collaboration leads to better outcomes for both you and your client. Its gotta be worth a better effort than what we’ve seen so far.

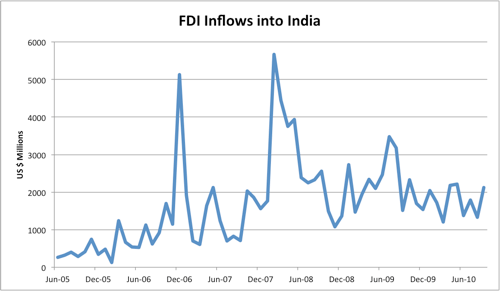

Investment Hates Uncertainty, Especially in the Law

A couple of unconnected things are throwing dark shadows over this dream run that Foreign Direct Investment into the Indian economy has been having. One, the Income Tax department’s claim on Vodafone for $2.5 B related to its acquisition of a controlling stake in Hutchison Essar. Two, the Andhra government’s crusade against the microfinance industry.

In both cases, the governments (central and Andhra) have good reason to act as they are. In the Vodafone case, there are grey areas when it comes to one offshore entity selling off a stake in an Indian company to another offshore entity. The microfinance industry has been charging rates on loans which become debt traps for poor villagers. Perhaps some regulation is in order.

But the way this is being done creates problems. When you change the rules of the game after investments have been made, future investors worry about making investments. FDI is the good sort of investment. It doesn’t turn tail and run when the markets are down. But if we are to encourage it, we have to take the regulatory uncertainty out.

Week’s Tweets 2010-11-14

- Interesting and important reading for MBAs | FT.com | The narcissistic world of the MBA student http://bit.ly/dovrwR #

- If you are at a services company with access restrictions | Browse the Web with your Email Address | Amit Agarwal http://bit.ly/dxL5ke #

- Change your b'date on Facebook to 1/1/01 to avoid the trouble of responding to bday wishes or the onus of wishing other people. #antisocial #

- Google stick with it! We need unlocked phones | Nexus S | GigaOm « http://bit.ly/cCdSmH #

- “the business case for electric vehicles is pretty good” Ray Lane | GE orders 25,000 EVs from GM http://bit.ly/d4SICJ #

- By an engineer, in bullet points | The Pros and Cons of Moving from US to India http://bit.ly/cRbBnN #

Kenya Challenges Corruption

There is something going on in Kenya. In the last 3 months several ministers have resigned an/or have been charged with corruption charges. Here are a few links.

What is it about the Indian system that makes it impossible to deal with corruption in high places?

Chart of the Day

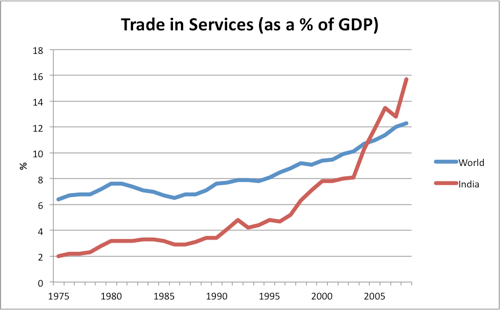

This chart plots the trend line for Trade in Services as a percent of GDP. Trade in Services includes both imports and exports. The data is from the World Bank’s excellent databank.

Till the mid 90s India’s Trade in Services was growing at about the same pace as the rest of the world. Then suddenly it took off. We know why that happened.

That is a structural shift in the composition of Indian trade, BoP and GDP itself. And the Offshore services sector is still growing.

Comparing Chinese Manufacturing and Indian Services

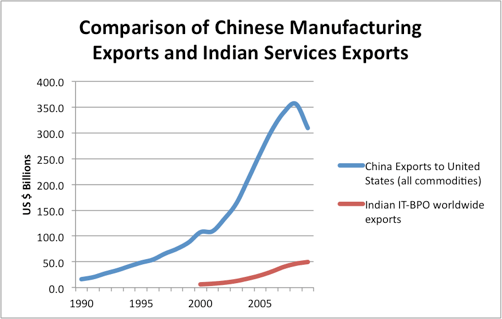

I was doing some number crunching for the book and came up with this chart.

When you hear the phrase “outsourcing of jobs to India and China”, which you do often in American politics today, there is going to be a tendency to put them both on an equal footing. But the scale is enormously different. The gap is probably even wider than the chart indicates because the data is for Chinese goods exports to the US and Indian IT-BPO exports worldwide. Assuming that productivity ($/worker) in Chinese manufacturing is below productivity in Indian services, the Chinese jobs that depend on exports to the US have got to be more than 10x the corresponding Indian jobs. And yet, India plays nice with its exchange rate while China has an effective peg to the US dollar. Go figure.

The data is from OECD and RBI.

Twitter Weekly Updates for 2010-11-07

- Wells fargo just declined a cc auth for me in India. Again. Anyone know a visa card that won't automatically get declined in India? #

- ..fit into 140 chars. <end of test> (3/3) #

- I'm trying out a a new service from Digital Inspiration which automatically splits a long tweet into multiple tweets. I .. (1/3) #

- ..never really figured how to write briefly. My blog posts are like essays. Naturally, the tweets too need a lot of work to .. (2/3) #

- Best advice on enterprise sales I've read in a long time. Startup Strategies: You Can’t Grow Without Process http://t.co/orNc82y via @gigaom #

- Grandparents setting off firecrackers inside their flat in India for our kids benefit on Skype. #

- Actually just a phooljhadi. Good thing no smoke alarm. #

- American politics taking their cues from unnamed sources in Indian press. Funny. | CNN.com http://bit.ly/avp1Da #

- Just installed Office for Mac. Next day macbook crashes. Needed a hard reboot. Everything slows down when Office app is open. #

Keane and Sonata

Last week NTT announced the acquisition of Keane. With roughly a billion dollars in revenue, this was a major acquisition, just a few months after their acquisition of Intelligroup, a $126 million IT Services company. Now, the ET reports that HCL and Ingram Micro are competing to acquire Sonata.

Earlier this year I was half complaining about why we weren’t seeing consolidation happening in the industry that is very fragmented. Well, that changed soon enough. This will only pick up speed from here on out. Investment bankers are going to quite busy for a year or two.

In a post about the reasons why companies will acquire in the Offshore industry I had laid out four key reasons (and discounted one). To summarize they were:

- Acquire Offshore Capability

- Market Footprint Expansion (Geo or Vertical)

- Capability Footprint Expansion (Service or Solution)

- Aggregate to Scale Up

NTT-Keane is actually about #4. NTT is aggregating offshore services companies to build a large offshore company which will have customer relationships through which they can sell other products and services. This is not an IBM-Daksh or an EDS-Mphasis type deal, which is what #1 is.

HCL-Sonata, if it were to happen would again be a Type 4 deal. It is interesting to speculate as to why small and mid-sized companies are open to selling right now. My hypothesis is that the recent recession shook them up. They realized that their companies didn’t have what it took to compete, when the market got competitive as it did when demand shrank. But they couldn’t have sold when valuations were low. Now that valuations are back, they see this as a good time to exit.

The future of the industry lies with the big and the innovative. The companies that are already in the big league are having a good time (except, for some reason, Wipro, at least this quarter.) Mid sized companies with low differentiation, will need to either acquire and bulk up themselves or hope that someone will acquire and rescue them.

The Cloud and Services

Yesterday, IBM put its cloud services under its Services arm. It will be sold by IBM Global Services. From the FT:

In its latest revamp, IBM said it would sell cloud computing through its services division, which generates nearly 60 per cent of its revenues.

This could be a defensive move to shore up IBM Global Services. IBM’s latest quarter was a good one with the sole exception of contract signings, which were down. IBM waved it away as something caused once in a while by lumpy contracts. But the fact is that customers aren’t doing big, long-term contracts the way they used to. They like smaller, flexible contracts. Applications outsourcing is definitely going that way. Ask TPI.

On the other hand, this doesn’t have to be a defensive move. It could be a brilliant, strategic move that gives them the edge in selling cloud services in a rapidly commoditizing market.

From offshore services companies, I hear a similar equivocation about cloud services. Some think that it is a threat, some think its an opportunity.

Cloud services are a long-term threat to ERP implementation revenues. Compare the implementation revenues from a salesforce.com implementation with a Siebel implementation. Revenues from Salesforce.com implementation and ongoing support (what’s that?) are tiny in comparison. Companies are willing to greatly simplify their own processes to fit the box that salesforce.com gives them. If that happened to all ERP implementations and support services, that won’t be good news for IT Services companies. This may take a decade to play out, but the trend has begun.

On the other hand moving a company’s infrastructure to the cloud, public and private, is a pretty interesting services opportunity.

But this threat/opportunity picture misses the woods for the trees. In the long-term, the cloud is going to be the biggest thing that happens to Services. Not IT Services specifically but outsourcing of services in general.

Outsourcing of services was enabled by enterprise IT and the internet. Before that, you couldn’t take the accounts payable guy away from the accounts payable office where he would cut checks based on paper invoices. Accounts payable and workflow systems and then networking and the internet allowed someone to perform the same function remotely. Today broadband is cheap and ubiquitous and the same job can be done offshore. In a way, enterprise IT systems and the internet started loosening internal services performed by employees from their moorings within the company.

The shift to the cloud is going to wrench them loose and finish the job. If companies can put their accounts payable system on multi-tenant SaaS, what reason could they have for performing the accounts payable function themselves?

The opportunity for Services companies will move from IT Services to business process platforms – a system and the service on top to perform a business function with standardized, well defined inputs and outputs. Much like how payroll services work today. The process will be fairly standardized, and the reason why companies will “settle” for a standardized process will be that the cycle time and cost of doing so will be so, so low that they would be stupid not to.

Why will the cost be so, so low? Because of multi-tenant SaaS, efficient, standardized processes and offshore wages.

The opportunity is massive, but business as usual won’t deliver the goods for services companies. Not this time, because they will face a new competitor – software companies. Today SaaS companies are essentially software companies, that rent software instead of selling it. Soon they’ll wise up and see the opportunity in providing a full solution. Or they’ll create an ecosystem of small service providers around them like Intuit has done in the small business market.

It’s going to be a brave new world for Services companies. But only the innovative will thrive.