I promised to share the survey results. So here goes. The sample size for all responses fell between 68 and 77. Which is a pretty decent sample size.

Interaction with the blog

A large portion of the sample don’t remember when they started reading the blog – which probably means that they have been reading it for more than a couple of years. But there does seem to be a significant percentage of relatively new readers. I like that. If I were a business I would want to both retain old customers but also keep getting new customers.

Readership on the website is surprisingly high. Just shows how even a tech savvy audience can differ in their preferences. Case in point is actually my own family. Vidya, my wife, is an avid reader and has more blogs bookmarked in her browser than I have in my feed reader. She prefers going to the websites. I prefer my Google Reader.

About the Reader

Only 4% of the sample was female. A little disappointing. I thought I was more popular with the ladies 🙂

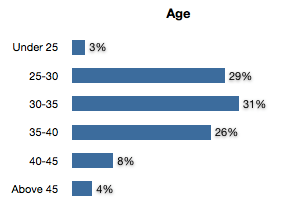

The age profile of the readers is well distributed.

97% of the readers grew up in India. Given my background and the things I write about, it is not surprising. The blog probably does get hits from a whole bunch of non-Indians but they are going there essentially to read a particular post, or because they were searching for something specific, not because they are regular readers.

56% of readers live in India. 36% in the United States.

The “home state” question turned up interesting results.

I asked the books question for a reason. Instead of asking the question “What subjects are you interested in?” I asked if readers had read books that indicated interest in the subject. There was no book on Offshore Services (until we write ours ;-D) so I picked Nandan Nilekani’s book as a proxy.

I guess nothing was surprising. Except perhaps the percentage of readers who have read Black Swan. But it is heartening to know that my readers are a bunch with varied interests.

Lot’s of engineers among my readers. Not surprising. A lot of MBAs too. Nice. But then that’s what I am.

The industry of employment also held no surprises. Management Consulting was not one of the choices. Perhaps it should have been.

Readers are well distributed across startups, small companies and big companies. The above 100,000 is overweight probably because of old friends from Infosys.

The qualitative feedback was in general positive and encouraging. Many of you wanted a higher frequency of posting and more engagement through comments. Also, more on the future of IT Services, entrepreneurship, balancing work and creative pursuits, life of a global Indian etc. Very good suggestions.

Time constraints get in the way of posting oftener, also because I tend to write long posts. I have started tweeting actively now, which allows me to have a short message outlet and I can also share interesting readings. My twitter handle is @basabp

Commenting is something I have gotten better at, I think. But I comment where I can achieve something in a short comment. Sometimes readers leave open-ended questions in the comments. I can’t always respond to them, but if someone else can, you are welcome to. I will be delighted if the comments section becomes a forum for the interchange of ideas with a very light touch from me. Many successful bloggers like Matt Yglesias have achieved that.

Thanks to all of you who took the time to respond. The survey is now closed.