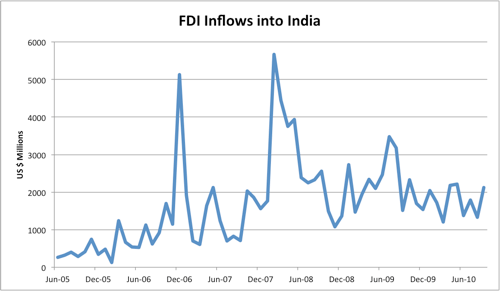

A couple of unconnected things are throwing dark shadows over this dream run that Foreign Direct Investment into the Indian economy has been having. One, the Income Tax department’s claim on Vodafone for $2.5 B related to its acquisition of a controlling stake in Hutchison Essar. Two, the Andhra government’s crusade against the microfinance industry.

In both cases, the governments (central and Andhra) have good reason to act as they are. In the Vodafone case, there are grey areas when it comes to one offshore entity selling off a stake in an Indian company to another offshore entity. The microfinance industry has been charging rates on loans which become debt traps for poor villagers. Perhaps some regulation is in order.

But the way this is being done creates problems. When you change the rules of the game after investments have been made, future investors worry about making investments. FDI is the good sort of investment. It doesn’t turn tail and run when the markets are down. But if we are to encourage it, we have to take the regulatory uncertainty out.

FDI investors for that matter are not greenhorns…They don’t expect all-things-firmed-up situation in any overseas market they invest because there’s no such market where everything (especially policy) is crystallized and clear… There will always be gray areas and to an extent, FDI can expect a premium on returns because of that very grayness…

…yet on this vodafone case, it was a clear case of “tax evasion” (not “tax planning” that is legitimate within the framework of the law) since the Indian Income Tax Act provides for retaining withholding tax on all sums paid to an overseas seller of any Indian asset… Here vodafone shares are clearly Indian assets generating revenue from Indian subscribers in Indian currency and the shareholder having an address outside India is clearly a tax evading device that should never be the criteria to judge tax incidence… Kudos to Indian tax administration… Vodafone deserve this slap..!!!

LikeLike

We tend to view FDI as a solution for India’s investment needs. I think we certainly need capital but am not sure how much we need FDI and if we have to depend on it at all. In recent times, investments needed in hi-tech startups to take them to market have plummeted. Is there a way we can not need capital or at least not need FDI?

LikeLike

Chaitanya – you are absolutely right. India no longer needs to bend over backwards for FDI. But investors everywhere, domestic or foreign respond the same way to regulatory risks.

LikeLike

“India no longer needs to bend over backwards for FDI. But investors everywhere, domestic or foreign respond the same way to regulatory risks.”

You can see more about that?

LikeLike